Author: Robert Finch, Senior Vice President of Underwriting, EmpiRx Health

In a world of rising healthcare costs with a growing focus on transparency in pharmacy benefits management, what are the key factors that clients and their benefits consultants should consider when choosing a PBM or any healthcare provider?

Let’s first take a look at the current state of how consultants analyze PBM proposals and present that information to their clients. Typically, benefits consultants simply summarize the client’s claims data, account for exclusions, drop in the discounts and rebates and do the math. But is this really the best way to find the best PBM for a client? Most consultants I talk to tell me they are trending all PBMs the same way regardless of their formulary approach and management/operating model.

What if consultants analyzed the data based on performance and cost trends that would be expected from each PBM, based on their particular strategies and approaches? The goal should be to try to get closest to the pin, right? If a PBM has a brand-over-generic strategy compared to one that employs a low-cost strategy, should they be assessed and considered in the same way?

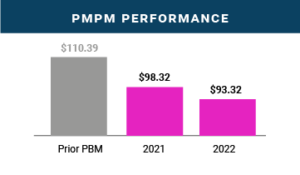

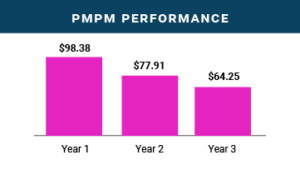

During my more than six years working at EmpiRx Health I have seen numerous examples of how clients’ performance has trended in a very positive direction due to our unique clinically-driven pharmacy care model. Below are just two examples of groups whose PMPMs dropped substantially as a result of EmpiRx Health’s clinically-driven approach that puts pharmacists at the center of the action. This strong PMPM performance can be found across EmpiRx Health’s book of business.

However, when I talk to consultants, they are frequently seeing performance trends of 10-15% each year from their large PBMs. This is driven by numerous factors, including formularies that drive brand over generic strategies, approving too many Prior Authorizations for high-cost, highly rebateable drugs, and simply not managing the overall clinical appropriateness of various claims.

The legacy PBMs’ default strategy has been based on the flawed assumption that if you push higher cost drugs you will receive higher rebates. When you really think about it, that strategy is wrong on so many fronts, both in terms of optimizing member health outcomes and reducing overall drug spending. For a large client prospect, we recently received a custom quote that included a ~30% increase in rebate value if we chose a formulary that preferred brands over generics as opposed to using EmpiRx Health’s Lowest Net Cost formulary. To me, that perfectly illustrates the PBM industry’s fallacy of driving higher rebates driven by increasing drug costs.

The bottom-line is that the traditional PBM focus on volume-driven rebates is the wrong prescription for addressing the real challenges facing clients today. High levels of rebates, but with poor clinical management, is a false choice for clients and their members. It’s time for clients and their consultants to reject the old PBM comparison spreadsheets that only perpetuate these failed pharmacy care strategies. A better pharmacy care future is founded on clinically-driven, evidence-based medication therapies that optimize patient care while helping to reduce overall drug spending.